IMF chief warns that credit crunch may take out large U.S. bank!

WASHINGTON - August 19, 2008 - The deepening

toll from the global financial crisis could trigger the failure of a large U.S.

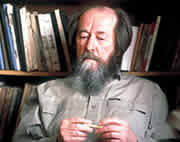

bank within months, a respected former chief economist of the International

Monetary Fund claimed today, fuelling another battering for banking shares.

Professor Kenneth Rogoff, a leading academic economist, said there was yet worse news to come from the worldwide credit crunch and financial turmoil, particularly in the United States, and that a high-profile casualty among American banks was highly likely.

“The U.S. is not out of the woods. I think the financial crisis is at the halfway point, perhaps. I would even go further to say the worst is to come,” Prof Rogoff said at a conference in Singapore.

In an ominous warning, he added: “We’re not just going to see mid-sized banks go under in the next few months, we’re going to see a whopper, we’re going to see a big one - one of the big investment banks or big banks,” he said.

Rising anxieties over “worse to come” in the credit crisis sent shares tumbling in Europe and Asia.

In London, the FTSE 100 index extended opening losses as widespread fears over the financial sector's woes led to another battering for stocks. The FTSE closed 129.8 points, or 2.38 per cent, lower at 5,320.4, pushing it into bear market territory - a level 20 per cent below the October 12, 2007 peak of 6730.71 - for the sixth time in two months. Germany's Dax shed 2.4%, while the CAC 40 in Paris lost 2.5%.

Professor Rogoff, who was chief economist at the IMF from 2001 to 2004, predicted that the crisis would foster a new wave of consolidation in the U.S. financial sector before it was over, with mergers between large institutions.

He also suggested that Fannie Mae and Freddie Mac, the struggling U.S. secondary mortgage-lending giants, were likely to cease to exist in their present form within a few years.

His prediction over the fate of Fannie and Freddie came after investors dumped the two groups’ shares on Monday after reports suggested that the U.S. Treasury may have no choice but to effectively nationalize them.

The professor also sounded a warning over rising U.S. inflation, which rose last month to its highest since 1991, and criticized the Federal Reserve for having cut American interest rates too drastically. “Cutting interest rates is going to lead to a lot of inflation in the next few years in the United States,” he said.

As investors' edginess over the threat of further financial turbulence sent equity markets into a further spin, bank shares were hit hardest. Among the biggest fallers in London trade were HBOS, down 6 per cent, Royal Bank of Scotland, whose shares plunged by 5 per cent, while HSBC fell 3.6 per cent. In continental Europe, Spain's Banco Santander was off 2.35 per cent, and BNP Paribas lost 3.8 per cent.

Persistent worries over the rapidly deteriorating economic outlook in the UK also saw sterling succumb to fresh losses. The pound lost almost a cent against the dollar, dropping to $1.881, above the near-two year lows plumbed on Friday.

Earlier, there were fresh jitters in Asia, with the region's leading bourses in sharp retreat after a dire overnight performance by Wall Street left the Dow Jones Industrial Average down by more than 180 points. Both Asian markets and Wall Street were unnerved by suggestions over the prospects for Fannie Mae and Freddie Mac.

While Japanese banks have remained relatively under-exposed to sub-prime mortgage products, many fear that they would be heavily exposed to a nationalization of Fannie and Freddie. The large Japanese financial houses hold around Y9.6 trillion (£47 billion) in bonds and mortgage-backed paper issued by housing finance groups in the U.S.

“If the recapitalization talk is realized, there are no assurances that the securities that have been issued [by U.S. mortgage firms] will be 100 per cent guaranteed,” said Yutaka Shiraki, a senior equity strategist at Mitsubishi UFJ Securities.

Financial sector shares were particularly badly hit in Tokyo, where they led the Nikkei 225 Index into a 300-point decline. The selling continued throughout the day, and peaked after a declaration by the Bank of Japan that the world’s second largest economy was now looking “sluggish”.

Although the central bank’s downbeat economic report included vague predictions of a return to growth over time, traders said that the comments had shattered any last hope that Asia’s export-led economy might somehow “decouple” from the woes in the U.S.

The picture was somewhat more stable in Shanghai, which spent a day in relative limbo following Monday’s 5.3 per cent nosedive. With Chinese stocks beating a daily retreat, investors are focused on the 2001 index high of 2,245-points. Some believe that level will hold up as a technical floor on the selling, others believe that it may shortly fail and unleash a much deeper collapse in stock values.